From Goals to Achievements,

all it takes is a Plan

Your plans deserve clarity, not emotion.

Together with Parrish Financial

We know that sound financial advice is the cornerstone of informed decision making, no matter what stage of life you are enjoying. That’s why we will partner with you for the long term and offer a unique and personalised experience that is tailored to your needs, as well as your individual lifestyle and financial goals and aspirations.

Services

Build Wealth

Protect Wealth

Manage Wealth

Meet the Team

We know that sound financial advice is the cornerstone of informed decision making, no matter what stage of life you are enjoying. That’s why we will partner with you for the long term and offer a unique and personalised experience that is tailored to your needs, as well as your individual lifestyle and financial goals and aspirations.

FAQs

How do financial planners get paid?

Financial planners may charge:

- Flat fees (eg. for a Statement of Advice)

- Hourly rates

- Ongoing service fees (combination of flat fees and percentage-based fees)

- Asset-based fees (a percentage of your portfolio)

At Parrish Financial, we offer transparent, upfront pricing with no hidden commissions.

Should I get a financial planner or do it myself?

If your finances are simple and you’re confident with budgeting and investing, DIY may work. But for major life events, complex portfolios, or long-term planning, a financial planner can provide tailored strategies, tax efficiency, and peace of mind.

Is it worth seeing a financial planner?

Yes. A financial planner helps you make informed decisions, avoid costly mistakes, and optimise your finances for long-term success. Whether it’s managing investments, planning for retirement, or protecting your wealth, professional advice often delivers value far beyond the cost.

Are financial planning fees tax deductible?

Some fees are tax deductible—particularly those related to managing income-producing investments or tax affairs. Initial advice fees are generally not deductible, but ongoing advice may be, depending on the nature of the service.

When should I see a financial planner?

Key times include:

- Starting your career or family

- Buying property or receiving an inheritance

- Approaching retirement

- Navigating aged care or estate planning

- The earlier you start, the more value you can gain.

What is your financial planning process?

Our process follows a structured six-step model:

1. Discovery Meeting – Understand your goals and values

2. Data Collection – Review your financial position

3. Strategy Development – Tailored recommendations

4. Statement of Advice – Formal written plan

5. Implementation – Putting the plan into action

6. Ongoing Annual Review – Adjusting as your life evolves

How much does it cost to see a financial planner?

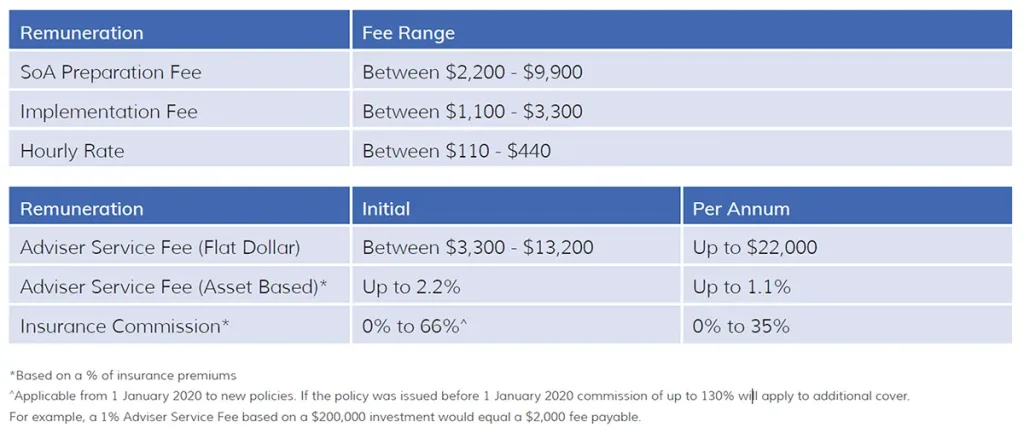

The cost of providing financial advice or service to you will depend on the nature and complexity of the advice, financial product and/or service provided. Your Adviser or the financial planning business may be remunerated by:

- Advice and service fees paid by you

- Commissions paid by insurance providers

The following table summarises the types of fees or commissions that are applicable to the services that we provide. Before providing you with advice, your Adviser will agree with you the fees that apply. All amounts are inclusive of Goods and Services Tax (GST).

What areas of financial planning do you specialise in?

We focus on:

- Wealth creation and protection

- Superannuation strategies

- Insurance

- Estate planning

- Retirement planning

- Aged care financial advice

Is the first meeting free?

Yes. Your initial meeting is obligation-free. It’s an opportunity to explore your goals and see how we can help.

Do you provide advice on superannuation and aged care?

Absolutely. We help clients optimise their superannuation and navigate aged care options, including funding strategies and Centrelink entitlements.

How often should I review my financial plan?

We recommend annual reviews, or more frequently if your circumstances change—such as a new job, property purchase, or family event.

How do I get started with Parrish Financial?

Call us on 07 4053 2888 or email [email protected] to enquire about an initial meeting.